Managing and processing multiple bank statements in various formats is a challenging task for CAs in India.

As demand for accuracy and efficiency grows, relying on manual data entry in accounting software like Tally becomes less viable. In the world of accounting, automation is key to saving time, reducing errors, and streamlining the workflow.

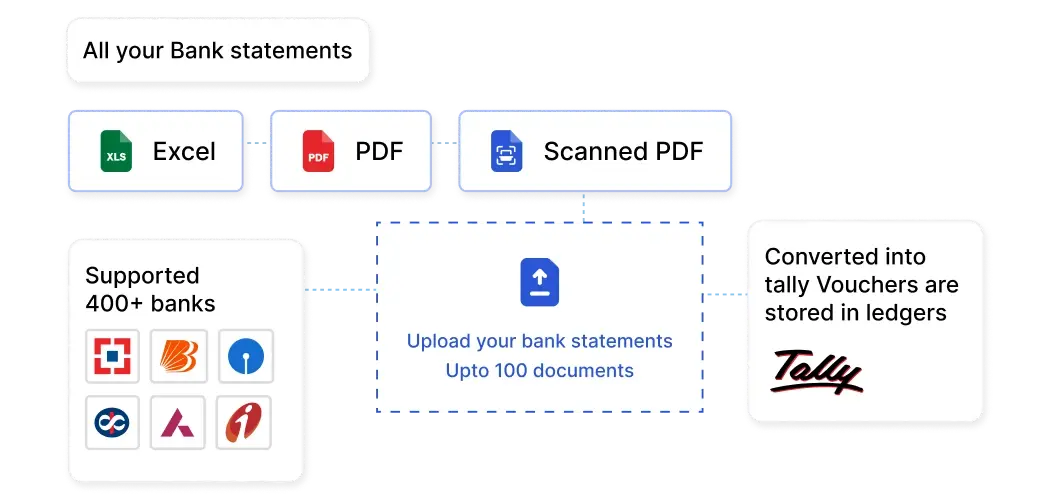

Vyapar TaxOne, an AI-driven platform, offers a seamless solution for importing multi-bank statement PDFs into Tally.

This blog will guide you through the step-by-step process of automating bank statement imports from over 400 supported banks into Tally, using Vyapar TaxOne's intelligent platform.

Whether you're handling Excel, PDF, or scanned PDF formats, this guide ensures you can import and reconcile bank data effortlessly.

Why Manual Importing of Bank Statements is a Challenge

The Complexity of Multi-Bank Statement Imports

When it comes to accounting, handling bank statements can be complex and time-consuming. Banks provide statements in various formats, including Excel, PDF, and scanned PDFs, each with its own structure.

This inconsistency creates additional challenges when entering data into accounting software like Tally.

Here’s a quick breakdown of common problems faced by CAs:

- Multiple Formats: Bank statements come in different formats (Excel, PDF, and scanned PDFs), each with its unique structure.

- Manual Data Entry: Transferring data manually from PDFs and other formats to Tally can be tedious and error-prone.

- Time-Intensive: Due to high transaction volumes, manual entry often takes too long, leaving little time for higher-value tasks.

The Need for Automation in Accounting

With automation, CAs can save precious hours, reduce human errors, and enhance overall productivity. By automating the import process, you can:

- Enhance Accuracy: Eliminate manual entry errors such as transposed digits, wrong ledger assignments, or missed transactions.

- Save Time: Automate bulk imports, allowing more time for detailed financial analysis, tax planning, and advisory services.

- Boost Efficiency: Focus on strategic tasks rather than repetitive data entry and reconciliation.

What is Vyapar TaxOne and How Can It Help?

Vyapar TaxOne’s Role in Streamlining Bank Statement Imports

Vyapar TaxOne is an AI-powered platform that seamlessly integrates with Tally ERP 9 and TallyPrime to automate bank statement import.

It supports multiple formats, including Excel, PDF, and scanned PDF files. With the ability to process data from over 400 banks, Vyapar TaxOne simplifies mapping, reconciling, and entering bank statement transactions into Tally.

Key Features of Vyapar TaxOne

- Multi-Format Support: Vyapar TaxOne supports a wide range of bank statement formats, including Excel, PDF, and scanned PDFs.

- 400+ Banks Supported: Over 400 banks are integrated into the Vyapar TaxOne platform, ensuring seamless imports for most businesses.

- AI-Powered Mapping: The AI system intelligently maps the bank statement data to the appropriate Tally ledgers, reducing the need for manual intervention.

- Bulk Processing: Import multiple bank statements in one go, saving time and effort.

- Audit Trail: Vyapar TaxOne maintains a detailed log of all imports, ensuring compliance and ease of tracking for future audits.

Step-by-Step Guide: Importing Bank Statement PDFs into Tally Using Vyapar TaxOne

Step 1: Prepare the Bank Statements

Before importing bank statements into Vyapar TaxOne, ensure they are prepared correctly. This step is critical for smooth and accurate data transfer.

- Consolidate Statements: Gather all the bank statements from the various banks you wish to import.

- File Format Check: Ensure that the statements are in Excel, PDF, or scanned PDF format. Vyapar TaxOne does not support CSV files.

- Consistent Naming Convention: Name the files systematically for easier identification during import.

Step 2: Sign In to Vyapar TaxOne

- Login: Use your Vyapar TaxOne credentials to log into the platform.

- Access the Banking Module: Navigate to the 'Bulk Upload' section and select the 'Banking' option to start the import process.

Step 3: Upload Bank Statements

-

Select the Relevant Company: Choose the company for which you’re importing the bank statement.

-

Upload the Files: Click the 'Import' button, then upload your bank statement files (Excel, PDF, or scanned PDF).

-

Processing Time: The time taken for processing varies based on the file type:

- Excel files: Up to 30 minutes.

- Original PDF files: Up to 1 hour.

- Scanned PDFs: Up to 12 hours.

Step 4: Review and Map Data

Once the files are uploaded, Vyapar TaxOne uses its AI to map the bank statement data to the appropriate Tally ledgers.

- Auto-Mapping: Vyapar TaxOne’s AI will attempt to auto-map transaction data to the correct Tally accounts (such as receipts, payments, and contra entries).

- Manual Adjustments: Review the mapped data and make any necessary corrections to ensure everything is properly aligned.

- Duplicate Detection: Vyapar TaxOne will flag duplicate entries, allowing you to review and correct them.

Step 5: Export Data to Tally

- Export: After reviewing and confirming that all data is mapped correctly, export the transaction details to Tally.

- Voucher Creation: Vyapar TaxOne will automatically generate Tally vouchers corresponding to the bank transactions.

- Reconciliation: Perform bank reconciliation within Tally to verify that all entries match the bank’s records.

Best Practices for Efficient Bank Statement Import

To make the most of Vyapar TaxOne’s features and ensure a smooth process, follow these best practices:

- Keep Vyapar TaxOne and Tally Updated: Regularly update both platforms to maintain compatibility and optimize performance.

- Maintain Consistency in Statement Formats: Ensure bank statements are formatted consistently to help the AI map data more accurately.

- Train Your Team: Provide training for your team members to maximize Vyapar TaxOne’s potential and minimize errors.

- Backup Tally Data: Regularly back up your Tally data to safeguard against any data loss during the import process.

Streamline Bank Statement Imports with Vyapar TaxOne

Importing multi-bank statement PDFs into Tally doesn’t have to be a cumbersome task. With Vyapar TaxOne, Chartered Accountants in India can streamline the entire process, making it faster, more accurate, and less error-prone.

By leveraging Vyapar TaxOne's automation capabilities, CAs can not only save time and effort but also focus on more strategic aspects of financial management. The seamless integration with over 400 banks and the support for Excel, PDF, and scanned PDF formats make Vyapar TaxOne an essential tool for modern accounting practices.

Embrace Vyapar TaxOne today and elevate your accounting workflow with AI-powered efficiency.

For a visual demonstration of the process, watch the following video:

FAQs

1. What file formats does Vyapar TaxOne support for importing bank statements to Tally?

Vyapar TaxOne supports importing bank statements into Tally in Excel, PDF, and scanned PDF formats.

2. How many banks are supported by Vyapar TaxOne for importing bank statements?

Vyapar TaxOne supports over 400 banks for seamless bank statement imports to Tally.

3. Can I import multiple bank statements at once using Vyapar TaxOne?

Yes, Vyapar TaxOne allows you to import multiple bank statements in bulk, saving you time and effort.

4. How long does it take for Vyapar TaxOne to process a bank statement?

Processing times vary by file type: Excel files take up to 30 minutes, original PDFs up to 1 hour, and scanned PDFs up to 12 hours.

5. Does Vyapar TaxOne automatically map bank statement data to Tally?

Yes, Vyapar TaxOne uses AI to automatically map bank statement data to the correct Tally ledgers, with the option for manual adjustments if needed.

Is Now Vyapar TaxOne | Same Trust, New Name!

Is Now Vyapar TaxOne | Same Trust, New Name!