GST reconciliation is an essential yet time-consuming task for businesses in India. Matching purchase and sales records with data from the GST portal (GSTR-1, GSTR-2A/2B) is necessary for accurate tax filings and claiming Input Tax Credit (ITC).

However, manual reconciliation comes with several challenges, including human error, time delays, and compliance risks.

This blog explores how you can streamline your GST reconciliation process using automation, specifically through Vyapar TaxOne's GST automation feature.

We'll delve into the benefits, features, and actionable steps for tax professionals looking to optimize their workflow.

What is GST Reconciliation?

GST reconciliation is the process of matching the data from your business's accounting books with the data available on the GST portal. This is essential for ensuring that the Input Tax Credit (ITC) claimed is accurate and that your GST returns are filed correctly.

Challenges in Manual GST Reconciliation

Here are the key challenges tax professionals face while doing manual GST reconciliation:

- Time-Consuming: Manual data entry and cross-checking require significant time and effort.

- Error-Prone: Human errors can lead to mismatches, penalties, and missed ITC claims.

- High Risk of Non-Compliance: Delays in reconciliation and filing lead to compliance risks, including penalties for incorrect or delayed returns.

- Scalability Issues: As transaction volumes increase, manual reconciliation becomes unsustainable.

Why Automation is the Key to Streamlining GST Reconciliation

In the current tax landscape, automation is the only way to ensure accuracy, speed, and efficiency in GST reconciliation. Let's look at how automation can help businesses overcome the challenges mentioned above.

Key Benefits of Automating GST Reconciliation

1. Increased Efficiency and Speed

- Automation significantly speeds up reconciliation by eliminating manual tasks like data entry and verification.

- Tasks that would take hours or days manually can now be completed in minutes.

2. Accuracy and Compliance

- Automation reduces the chances of human errors by automatically matching data and identifying discrepancies.

- It helps maintain accurate records, ensuring compliance and minimizing audit risks.

3. Optimized ITC Claims

- Automated systems identify any unclaimed ITC, helping businesses maximize their tax credits and reduce liabilities.

4. Scalability

- Automation tools like Vyapar TaxOne can handle high transaction volumes, allowing businesses to scale with existing staff.

How Vyapar TaxOne's GST Automation Feature Works

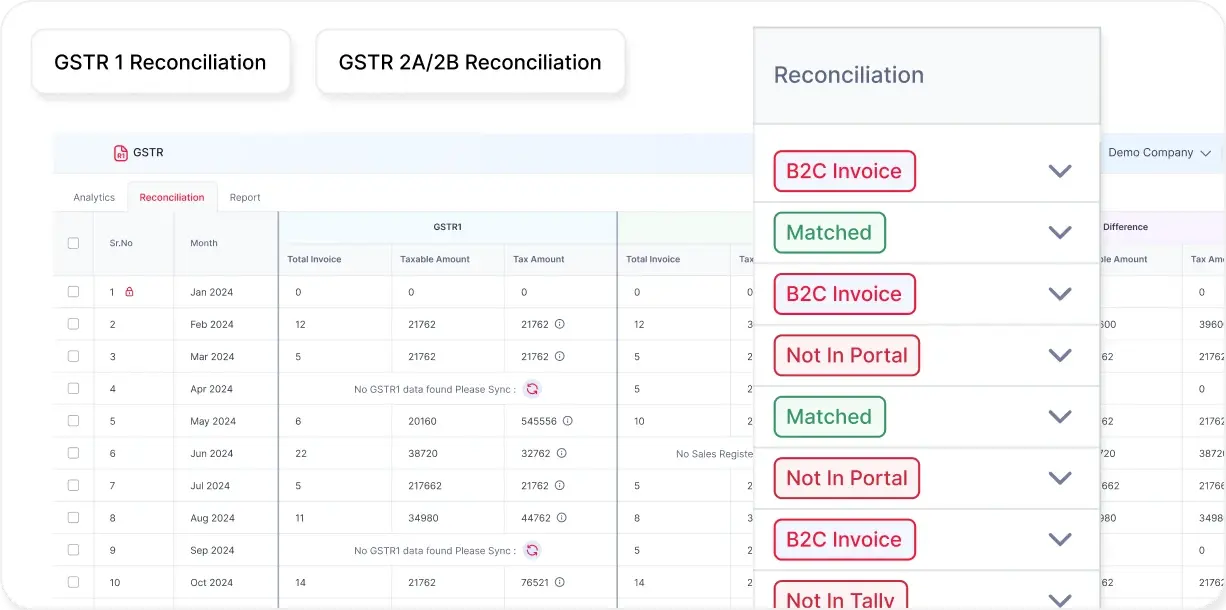

Vyapar TaxOne is designed to automate GST reconciliation seamlessly, making it an ideal solution for tax professionals. Let's break down how it works:

1. Intelligent Reconciliation Engine

Vyapar TaxOne's intelligent reconciliation engine compares data from sources such as GSTR-1, GSTR-2A/2B, and Invoice Management Systems (IMS). It automatically matches invoices to GST records and flags discrepancies in real time.

- Time-saving: No need for manual data entry or cross-checking.

- Intelligent error detection: Flags mismatches immediately, allowing you to address them on time.

2. Seamless Integration with Accounting Tools

Vyapar TaxOne integrates seamlessly with Tally, Vyapar, and Excel. This ensures that all your accounting data is synchronized, eliminating the need for manual data imports.

| Accounting System | Vyapar TaxOne Integration | Benefit |

|---|---|---|

| Tally | Syncs directly with Tally | Seamless data transfer |

| Vyapar | Automated sync with Vyapar | Real-time updates |

| Excel | Imports and exports Excel data | Streamlines reconciliation |

3. AI-Enabled Invoice Processing and Smart Checks

Vyapar TaxOne uses Artificial Intelligence (AI) to extract data from invoices (even in PDF or image format) and auto-populate it into the reconciliation tool.

It also performs over 30 smart validation checks, identifying common errors like mismatched tax amounts or incorrect HSN codes before filing.

- AI processing: Automatically extracts and enters data, reducing human intervention.

- Smart checks: Over 30 validation checks ensure that data is accurate before filing.

4. Client Collaboration and Workflow Tracking

Vyapar TaxOne includes built-in features for client communication and workflow tracking, enabling tax professionals to collaborate with clients and easily monitor reconciliation progress.

- Collaboration tools: Send reminders and requests for missing documents directly through the platform.

- Progress tracking: Monitor reconciliation status in real time.

How to Implement Vyapar TaxOne for GST Reconciliation

Getting started with Vyapar TaxOne's GST automation is simple. Here's a step-by-step guide to help you integrate this tool into your workflow:

1. Audit Your Current Reconciliation Process

Before deploying Vyapar TaxOne, take time to audit your existing processes. Assess your accounting data, invoice formats, and reconciliation practices. This will help you understand where automation can save the most time.

- Review your existing accounting systems.

- Ensure all your invoice formats are standardized.

2. Deploy Vyapar TaxOne

Once your data is prepared, integrate Vyapar TaxOne with Tally. Customize the reconciliation rules based on your business's needs, such as setting invoice tolerance for GST.

3. Run Parallel Workflows

Initially, run Vyapar TaxOne in parallel with your existing manual workflow. This will allow you to compare results and adjust the tool's settings if needed.

- Test phase: Run both systems side by side to validate automated reconciliation accuracy.

- Adjust settings: Refine the reconciliation rules as you identify any discrepancies.

4. Train Your Team

Training your team on Vyapar TaxOne's features and functionality will ensure a smooth integration and practical use. Regular training will help your team get the most out of the tool.

Best Practices for GST Reconciliation Automation

To maximize the benefits of Vyapar TaxOne, follow these best practices:

1. Establish a Regular Reconciliation Schedule

Don't wait until the last minute to start the reconciliation process. Schedule weekly or monthly reconciliations to identify and correct errors early.

- Avoid delays: Reconcile regularly to stay ahead of deadlines.

- Timely filing: Automated systems ensure that your filings are on time.

2. Promptly Address Discrepancies

Monitor the exceptions flagged by Vyapar TaxOne and resolve discrepancies as soon as they arise. Delayed responses can lead to ITC blocking or compliance issues.

- Proactive resolution: Quickly address flagged discrepancies.

- Improve accuracy: Regularly check the exception reports to fine-tune your system.

3. Maintain Audit-Ready Documentation

Always keep detailed logs of reconciliations, including actions taken on flagged exceptions. This documentation will be valuable in the event of future audits or compliance checks.

- Documentation: Save exception reports and corrective actions taken.

- Audit readiness: Ensure all necessary documentation is in place for future audits.

Embrace Automation for Efficient GST Reconciliation

Incorporating Vyapar TaxOne's GST automation can significantly improve your reconciliation process by enhancing speed, accuracy, and compliance. The intelligent reconciliation engine, seamless integrations, and AI-enabled features will help you streamline GST reconciliation, optimize ITC claims, and stay ahead of deadlines.

Tax professionals who embrace automation will not only save valuable time but also ensure their clients' compliance with the ever-evolving GST regulations. By adopting Vyapar TaxOne, you're investing in a future-proof, scalable solution that adapts to your business's needs.

Take the first step toward streamlining your GST reconciliation workflow today. Try Vyapar TaxOne for free for a week and experience a hassle-free approach to tax compliance.

FAQs

Q1. What is GST reconciliation?

GST reconciliation is the process of matching your business's purchase and sales data with the GST portal to ensure accurate tax filing and claim eligible Input Tax Credit (ITC).

Q2. How can automation improve GST reconciliation?

Automation speeds up the reconciliation process, reduces human errors, ensures compliance, and optimizes ITC claims by integrating accounting systems and performing real-time data validation.

Q3. What are the benefits of using Vyapar TaxOne for GST reconciliation?

Vyapar TaxOne offers features like intelligent reconciliation, AI-driven invoice processing, seamless integrations with accounting tools, and real-time discrepancy identification, ensuring accurate and timely GST filings.

Q4. Is Vyapar TaxOne easy to integrate with existing accounting systems?

Yes, Vyapar TaxOne integrates seamlessly with popular accounting tools like Tally & Vyapar, making it easy to synchronize data for efficient GST reconciliation.

Q5. How often should GST reconciliation be performed?

It's recommended to schedule regular reconciliations, ideally weekly or monthly, to catch discrepancies early and avoid last-minute rushes before filing deadlines.

Is Now Vyapar TaxOne | Same Trust, New Name!

Is Now Vyapar TaxOne | Same Trust, New Name!